It seems it is time for small-sized Internet and technology IPOs. After Internet Brands, Inc. went public on NASDAQ, LogMeIn, Inc. filed to do so now Al Gore’s Current is looking forward to do the same. Unlike Internet Brands Inc and LogMeIn, Inc, Current TV is purely from the web 2.0 age, so it would be of particular interest for all companies from the web 2.0 sector to see how the company goes public and what is going to happen after their IPO. The company is planning to raise $100M on $63.8M revenues for the last year with operating losses in the $6M range.

Current TV is, under no doubt, mostly popular due to its co-founder the ex Vice President Al Gore. The registrant is Current Media, Inc., which is the parent company for current.com and Current TV. It has filed to trade on the NASDAQ Global Market under the symbol CRTM.

Current is a global participatory media company with the goal of democratizing media by engaging, informing and  enriching our young adult audience and encouraging their participation across platforms. The company operates a television network, Current TV, and a website, Current.com, where they all distribute viewer-created content as well as internally developed and acquired content that is relevant to the lives of young adults. The company believes the combination of their television and Internet platforms creates an immersive and interactive viewer experience for our growing global audience, where the audience participates in both the creation and selection of the content it engages with on both Current TV and Current.com.

enriching our young adult audience and encouraging their participation across platforms. The company operates a television network, Current TV, and a website, Current.com, where they all distribute viewer-created content as well as internally developed and acquired content that is relevant to the lives of young adults. The company believes the combination of their television and Internet platforms creates an immersive and interactive viewer experience for our growing global audience, where the audience participates in both the creation and selection of the content it engages with on both Current TV and Current.com.

The company’s primary sources of revenue are affiliate fees and advertising. Affiliate fees are derived from long-term distribution agreements with cable, satellite and telecommunications operators who pay Current Media, Inc. a monthly fee for each subscriber household that receives Current TV. In the United States, the company’s affiliate customers include DirecTV, Comcast, EchoStar, Time Warner and AT&T. In the United Kingdom and Ireland, affiliate customers include British Sky Broadcasting, or BSkyB, and Virgin Media. In the Spring of 2008, the company has plans to launch in Italy on Sky Italia. Advertising revenue is derived from advertisers who pay for sponsorships and spot advertisements. Selected advertising customers include Toyota, T-Mobile, Johnson & Johnson, General Electric, Geico and L’Oreal. Affiliate revenues accounted for 84% of the company’s total revenues for 2007.

Current TV was launched in August 2005 in approximately 19 million subscriber households in the United States and is now available in approximately 51 million subscriber households in the United States, the United Kingdom and Ireland. In 2006 and 2007, the company recorded revenue of $37.9 million and $63.8 million, respectively where the operating losses were $4.8 million in 2006 and $6.1 million in 2007.

The company intends to use a portion of the net proceeds from this offering to repay in full the principal and accrued interest on an outstanding loan from Dylan Holdings, Inc., which amounted to $30.4 million as of December 31, 2007. The loan is in the form of a senior purchase money note, has an interest rate of 9.25% and matures in May 2008. The company issued this note in May 2004 as part of the purchase price for our acquisition of the NWI television network. NWI television network was purchase in 2004 for $70.9 million, including intangible assets consisting of affiliate distribution arrangements valued at $13.7 million.

The company also intends to use a portion of the net proceeds from this offering to repay in full the principal and accrued interest on their outstanding promissory notes, which amounted to $6.1 million at December 31, 2007. The entered into a note purchase agreement in September 2006 with a consortium of lenders pursuant to which they issued the revolving promissory notes. All of these lenders are currently equity investors in the company. Under the terms of these notes, they borrowed $5M and have made no payments. These notes bear interest at a rate of 15% for the first year and 18% thereafter, which compounds quarterly. In accordance with the terms of these notes, interest is added to the principal through May 4, 2008, at which time the unpaid principal and interest become payable in full.

The company intends to use a portion of the net proceeds from this offering to repay in full the principal and accrued interest on an outstanding note payable to Oracle Credit Corporation, which amounted to $64,000 at December 31, 2007. The company entered into this note payable in May 2006 in connection with the purchase of software and support. The note bears interest at the rate of 9.83%. Under the terms of the note, interest is added to the principal balance. The note requires annual payments of $36,000 on the first day of September of each year until 2009, at which time the final payment of $36,000 is due.

The remaining net proceeds from this offering is planned to be used for working capital and other general corporate purposes. Additionally, the company might also expand their existing business through acquisitions of other complementary businesses, products, services or technologies, although no agreements are currently in place for such acquisitions at this time.

Basically Current relies on its innovative approach, although it is called in their prospectus “innovative but unprovenâ€.

Current was founded with the goal of cost-effectively engaging young adults with news, entertainment and lifestyle programming centered on what is going on in their world. We recognized that to reach young adults it was necessary to reach them via television, where they spend a lot of time and where there is a proven business model, as well as on the Internet, a medium where they are also very active. To do this, we launched a television channel, Current TV, and more recently a website, Current.com. The two serve as distinct consumer destinations, but they are also symbiotic and form a combined platform with which Current engages its audience. Key aspects of our solution include:

Current’s new network model.

Our focus on user-generated content provides a unique connection with our young adult audience. We engage young adults by telling stories in their voices and from their perspectives. We have redefined the scope of “news” for young adults, and broadened our programming to include an array of subjects that are important to our audience.

Current’s programming.

Current has developed a programming model built on several unique content offerings, all designed to reflect the tastes and lifestyles of our target 18-34 year-old audience. Our programming is presented in short segments that we call “pods,” which are typically 2-10 minutes in length, rather than traditional half-hour or hour-long programming blocks.

Current’s innovative advertising solution.Â

Our advertising model is designed to appeal to the lifestyles, tastes and needs of young adults. A key solution that we provide advertisers is the ability to let our young adult viewers create commercials that we then air on Current TV. In addition to these viewer created ad messages, or VCAMs, we offer other attractive sponsorship solutions, in which advertisements are integrated with and embedded into our content, providing advertisers a marketing forum that is free from ad-skipping.

Current’s all digital broadcast facility.Â

Our TV broadcast facilities are built on an open IP architecture as opposed to traditional broadcast television legacy systems. Unlike high-cost production facilities at traditional cable networks, we have deployed a new, all-digital infrastructure that allows us to produce, acquire and distribute high quality content at a low cost.

Current.com.  Â

Current.com serves several purposes: it is a news, information and entertainment source for young adults online; it is a real-time connection to programming on Current TV; and it is a platform for collaborative media production. At its core, Current.com is a social news feed.

More about Current TV

Since its inception in 2005, Emmy award-winning Current TV has been the world’s leading peer-to-peer news and  information network. Current is the only 24/7 cable and satellite television network and Internet site produced and programmed in collaboration with its audience. Current connects young adults with what is going on in their world, from their perspective, in their own voices.

information network. Current is the only 24/7 cable and satellite television network and Internet site produced and programmed in collaboration with its audience. Current connects young adults with what is going on in their world, from their perspective, in their own voices.

With the launch of Current.com, the first fully integrated web and TV platform users can participate in shaping an ongoing stream of news and information that is compelling, authentic and relevant to them.

Current pioneered the television industry’s leading model of interactive viewer created content (VC2). Comprising roughly one-third of Current’s on-air broadcast, this content is submitted via short-form, non-fiction video “pods”. Viewer Created Ad Messages (VCAMs) are also open to viewer’s participation.

Current’s programming ranges from daily pop culture coverage to political satire in “SuperNews,” unprecedented music journalism in “The Current Fix,” and unique insights into global stories through Vanguard and Citizen Journalism.

Current is now viewed in the U.S. and U.K. in more than 51 million households through distribution partners Comcast (Channel 107 nationwide), Time Warner (nationwide), DirecTV (channel 366 nationwide), Dish Network (channel 196 nationwide), Sky (channel 193) and Virgin Media Cable (channel 155).

The company is headquartered in San Francisco, California and as of December 31, 2007 employed 391 full-time employees. They also have an office in London, production studios in Los Angeles and an advertising sales office in New York City. The company was initially formed as a limited liability company in Delaware in September 2002 named INdTV, LLC. On May 4, 2004, they have purchased Newsworld International, or NWI, a traditional cable and satellite network. This acquisition enabled the company to gain access to cable and satellite distribution as an independent network. In connection with that acquisition of NWI, they’ve changed their name to INdTV Holdings, LLC and concurrently formed a wholly owned subsidiary INdTV, LLC, a Delaware limited liability company, and transferred all of their operations to INdTV, LLC. Since that time, they have had no operations because all operations are conducted by their subsidiaries. On April 4, 2005, they changed the name of INdTV Holdings, LLC to Current Media, LLC and INdTV, LLC to Current TV, LLC. On August 1, 2005, they terminated NWI’s existing programming and launched Current TV in the United States.

The company faces significant competition in both the cable television and online markets in which they operate. Current TV competes with other television networks that target young adults. These networks include Comedy Central, Fuse, G4, MTV, Spike TV and other major cable networks that are owned by large media conglomerates, such as Comcast, Disney, Time Warner and Viacom. Current.com faces competition from companies that are consumer destination websites, such as AOL, Google, MSN and Yahoo!, online video aggregators, such as Hulu and YouTube, and news and social network platforms, such as del.icio.us, digg.com, Facebook and MySpace.

Executive officers

Albert Gore, Jr. co-founded Current in 2002. He has served as our Executive Chairman and as a member of our board of  directors since September 2002, and was elected as Chairman of our board of directors in May 2004. Mr. Gore has served as a Senior Advisor to Google, a global Internet company, since February 2001, and a member of the board of directors of Apple, a consumer electronics company, since March 2003. He has also served as Chairman of Generation Investment Management, an investment management firm, since 2004 and joined Kleiner Perkins Caufield & Byers, a venture capital firm, as a partner in November 2007. He has served as a visiting professor at Middle Tennessee State University. Mr. Gore served as the 45th Vice President of the United States from 1993 to 2001, during which time he also served as President of the United States Senate and as a member of the Cabinet and the National Security Council. Prior to 1993, he served eight years in the United States Senate and eight years in the United States House of Representatives. Mr. Gore was co-winner of the 2007 Nobel Peace Prize. Mr. Gore holds an A.B. from Harvard University.

directors since September 2002, and was elected as Chairman of our board of directors in May 2004. Mr. Gore has served as a Senior Advisor to Google, a global Internet company, since February 2001, and a member of the board of directors of Apple, a consumer electronics company, since March 2003. He has also served as Chairman of Generation Investment Management, an investment management firm, since 2004 and joined Kleiner Perkins Caufield & Byers, a venture capital firm, as a partner in November 2007. He has served as a visiting professor at Middle Tennessee State University. Mr. Gore served as the 45th Vice President of the United States from 1993 to 2001, during which time he also served as President of the United States Senate and as a member of the Cabinet and the National Security Council. Prior to 1993, he served eight years in the United States Senate and eight years in the United States House of Representatives. Mr. Gore was co-winner of the 2007 Nobel Peace Prize. Mr. Gore holds an A.B. from Harvard University.

Joel Hyatt co-founded Current in 2002. He has served as a member of our board of directors and as our Chief Executive Officer since September 2002. Mr. Hyatt has served as a member of the board of directors of Hewlett-Packard Company, a computer electronics company, since May 2007 and as a member of the Board of Trustees of the Brookings Institution since May 2001. From September 1998 to June 2003, Mr. Hyatt was a Lecturer in Entrepreneurship at the Stanford University Graduate School of Business. Previously, Mr. Hyatt was the founder and Chief Executive Officer of Hyatt Legal Plans, Inc., a provider of employer-sponsored group legal plans, and of Hyatt Legal Services, a multi-state legal services firm. Mr. Hyatt holds an A.B. from Dartmouth College and a J.D. from Yale Law School.

Mark Goldman has served as our Chief Operating Officer since December 2003. From July 1999 to December 2003, Mr. Goldman served as a consultant in the media and communications industries. Prior to that time, Mr. Goldman served as Chief Operating Officer for Sky Latin America, a division of News Corp., which provides satellite television service to Latin America, and as an executive at MCA/Universal Television, where he was responsible for business development and the launch of several international cable networks. Mr. Goldman has a B.S. in Economics from The Wharton School at the University of Pennsylvania.

Paul Hollerbach has served as our Chief Financial Officer since October 2007. From August 1997 to January 2007, Mr. Hollerbach worked at Yahoo!, a leading global internet company, where he held a broad range of senior financial roles. At Yahoo!, Mr. Hollerbach most recently served as Vice President, Finance and Investor Relations, and previously served as Vice President, Corporate Controller. Prior to Yahoo!, Mr. Hollerbach held various finance positions at Silicon Graphics, a computer electronics company, and served at KPMG LLP and Ernst & Young LLP, managing technology clients in their assurance practices. Mr. Hollerbach holds a B.S. in Business Administration from California State University, San Luis Obispo and is a licensed CPA in California.

David Neuman has served as our President of Programming since October 2004. From October 2003 to October 2004, Mr. Neuman researched the development of several television and feature film projects and incorporated his own production company, Blackrock Productions, working on primetime television and feature film projects. From January 2001 to October 2003, Mr. Neuman was Chief Programming Officer of CNN Networks, an international television news organization. Prior to that time, Mr. Neuman served as President of Walt Disney Television and Touchstone Television, a television studio. Mr. Neuman graduated from the University of California, Los Angeles in 1983 with an A.B. in Communication Studies.

Joanna Drake Earl joined us in September 2002 and has served as our President of New Media since October 2004. From September 2002 to October 2004, Ms. Drake Earl served as our Senior Vice President of Strategic Partnerships. From February 2001 to July 2002, Ms. Drake Earl was Vice President, Content Strategy, at Digeo, Inc. (formerly Moxi Digital, Inc.), which develops multi-media devices and consumer media applications. Previously, Ms. Drake Earl served as a senior media industry consultant at Booz Allen & Hamilton, an international consulting firm. Ms. Drake Earl holds a B.A. from the University of California, Berkeley and an M.A. from Stanford University.

Joshua Katz has served as our President of Marketing since December 2006. From February 2006 to December 2006, Mr. Katz served as Chief Marketing Officer at TiVO, a provider of digital video equipment and services. From July 2005 to January 2006, Mr. Katz was Vice President of Marketing for Lucasfilm, a film studio. From March 1999 to June 2005, Mr. Katz was President of The Halo Effect, a marketing and brand consulting firm. Previously, Mr. Katz served as Senior Vice President of Marketing at both the Cartoon Network and VH1 cable networks. Mr. Katz has a B.A. from Tulane University.

Directors

Richard C. Blum has served as a member of our board of directors since May 2004. He is the Chairman and President of Richard C. Blum & Associates Inc., the general partner of Blum Capital Partners, L.P., a long-term strategic equity investment management firm that acts as general partner for various investment partnerships and provides investment advisory services, which he founded in 1975. He has also served as the Chairperson and a member of the board of directors of CB Richard Ellis Group, Inc. since 2001. Mr. Blum holds a B.A. and an M.B.A. from the University of California, Berkeley.

Ronald Burkle has served as a member of our board of directors since May 2004. Mr. Burkle is managing partner and majority owner of The Yucaipa Companies, a private investment firm that he co-founded in 1986. Mr. Burkle has also served as a director of Occidental Petroleum Corp. since 2005, KB Home Corporation since 1995, and Yahoo! since 2001.

Edward Renwick has served as a member of our board of directors since May 2004. Mr. Renwick is a partner of The Yucaipa Companies, a private investment firm where he has worked since 1999. Prior to that, Mr. Renwick served as a consultant at The Boston Consulting Group, a strategic consulting firm. Mr. Renwick holds a B.A. from Stanford University and a J.D. and M.P.P. from Harvard University.

Mark Rosenthal has served as a member of our board of directors since May 2004. From June 2005 to December 2006, Mr. Rosenthal served as Chairman and CEO of Interpublic Media, the media operations organization of the the Interpublic Group of Companies. From July 1996 to July 2004, Mr. Rosenthal served as President and Chief Operating Officer of MTV Networks, a cable network. Prior to becoming President and COO of MTV Networks, Mr. Rosenthal rose through positions of increasing responsibility in the affiliate sales and marketing organization at MTV Networks and its predecessor company, Warner Amex Satellite Entertainment Company, ultimately supervising the sales, distribution and marketing for all of MTV Networks’ domestic television networks. Mr. Rosenthal joined Warner Amex Satellite Entertainment Company in 1982. He has also served as a member of the board of directors of CNET Networks since April 2007. Mr. Rosenthal has a B.A. from Kenyon College and an M.F.A. from Yale University.

Orville Schell has served as a member of our board of directors since May 2004. Since January 2007, Mr. Schell has been the Director of the Center on U.S.-China relations at the Asia Society. From January 1997 to January 2007, Mr. Schell served as the Dean of the Graduate School of Journalism at the University of California, Berkeley. Mr. Schell holds a B.A. from Harvard University and an M.A. from the University of California, Berkeley.

Major stockholders include Al Gore, entities affiliated with Blum Capital Partners, L.P., Yucaipa Corporate Initiatives Fund I, L.P., DirectTV, Inc. and Comcast CTV Holdings, LLC. Underwriters include J.P. Morgan Securities Inc., Lehman Brothers Inc. and Pacific Crest Securities Inc.

More

http://current.com

http://current.com/tv

http://www.sec.gov/Archives/edgar/data/1424470/000104746908000572/a2182152zs-1.htm

http://current.com/items/88827879_current_files_for_100m_ipo

http://www.paidcontent.org/entry/419-current-media-files-for-100-million-ipo/

http://www.readwriteweb.com/archives/current_files_for_ipo.php

http://www.readwriteweb.com/archives/current_tv.php

http://www.readwriteweb.com/archives/al_gore_current_re-defining_television.php

http://today.reuters.com/news/articlenews.aspx?type=technologyNews&storyid=2007-10-16T030718Z_01_N15319230_RTRUKOC_0_US-INTERNET-TELEVISION-CURRENT.xml [the story is down]

https://web2innovations.com/money/2008/01/15/logmein-files-for-an-ipo-hoping-to-raise-86m/

https://web2innovations.com/money/2008/01/14/internet-brands-inc-went-public-on-nasdaq/

http://en.wikipedia.org/wiki/Al_Gore

http://www.hoovers.com/yucaipa/–ID__40153–/free-co-factsheet.xhtml

fundamental shift in Internet usage patterns is shaping Mobile Web development, driving subscriber adoption and forcing structural changes within the industry. At the core of this evolution is the user as a creator and consumer of content (i.e. the prosumer), and the ‘social web’ – which describes a wide variety of social computing tools enabling users to develop detailed Web identities, create online communities and communicate with like-minded individuals.

fundamental shift in Internet usage patterns is shaping Mobile Web development, driving subscriber adoption and forcing structural changes within the industry. At the core of this evolution is the user as a creator and consumer of content (i.e. the prosumer), and the ‘social web’ – which describes a wide variety of social computing tools enabling users to develop detailed Web identities, create online communities and communicate with like-minded individuals.

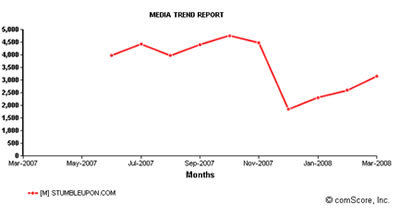

March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering.

March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering. seem to drag the attention of influential technology bloggers to the number of their registered users and the number of their stumbles.

seem to drag the attention of influential technology bloggers to the number of their registered users and the number of their stumbles.

42, is also a founder and Executive Producer of the Web 2.0 conferences and “band manager” with

42, is also a founder and Executive Producer of the Web 2.0 conferences and “band manager” with  release announcing the acquisition of Corbis in a deal valued over $600M rebranding their logo and giving Corbis independency after the deal closes. Here is theÂ

release announcing the acquisition of Corbis in a deal valued over $600M rebranding their logo and giving Corbis independency after the deal closes. Here is the  guarantee some minimum flat pay outs to its publishers. Today, we have read on web, this practice seems to be changing – Glam is no longer going to pay for the entire

guarantee some minimum flat pay outs to its publishers. Today, we have read on web, this practice seems to be changing – Glam is no longer going to pay for the entire  Samir Arora founded lifestyle hub Glam Media to create a better way for brand advertisers to connect with their audiences on the Web. A tech-industry veteran, Arora was previously the chairman of Emode/Tickle, Inc, which was later sold to

Samir Arora founded lifestyle hub Glam Media to create a better way for brand advertisers to connect with their audiences on the Web. A tech-industry veteran, Arora was previously the chairman of Emode/Tickle, Inc, which was later sold to

only interesting thing in the story. After firing most of its staff leaving only one sysadmin to keep the site alive and put its offices up for rent some more horrible stories from ex-employees appeared publicly.

only interesting thing in the story. After firing most of its staff leaving only one sysadmin to keep the site alive and put its offices up for rent some more horrible stories from ex-employees appeared publicly.

Adams Street Partners

Adams Street Partners at

at  founded Pluck as a Venture Partner at

founded Pluck as a Venture Partner at  across the media spectrum: as a client, at an agency, as a publisher, and with an advertising network. Most recently, he worked as an M&A and strategy consultant for several Internet properties and investment firms, and also served as SVP of Corporate Development for Exponential Interactive, Tribal Fusion’s parent company. Previously, he was SVP of Business Development for Fox Interactive Media, and was the Vice President of Business & Corporate Development at IGN Entertainment (acquired by Fox Interactive), where he led the company’s M&A, business development and international activities. Before joining IGN, Richard led national accounts sales at Lycos, was Vice President of Business Development at Neopost Online, served as Senior Vice President/Managing Director of Answerthink, and founded K23 Creative Services in Singapore. His early career included management roles for Ford, IBM and Siemens, and he has a B.S. in business administration from the University of Southern California and an M.B.A. from the University of Washington.

across the media spectrum: as a client, at an agency, as a publisher, and with an advertising network. Most recently, he worked as an M&A and strategy consultant for several Internet properties and investment firms, and also served as SVP of Corporate Development for Exponential Interactive, Tribal Fusion’s parent company. Previously, he was SVP of Business Development for Fox Interactive Media, and was the Vice President of Business & Corporate Development at IGN Entertainment (acquired by Fox Interactive), where he led the company’s M&A, business development and international activities. Before joining IGN, Richard led national accounts sales at Lycos, was Vice President of Business Development at Neopost Online, served as Senior Vice President/Managing Director of Answerthink, and founded K23 Creative Services in Singapore. His early career included management roles for Ford, IBM and Siemens, and he has a B.S. in business administration from the University of Southern California and an M.B.A. from the University of Washington. industry experience. Before founding Technorati, Dave was cofounder and CTO of Sputnik, a Wi-Fi gateway company, and previously, he was cofounder of Linuxcare, where he served as CTO and VP of Engineering. Dave also served as a founding member of the board of Linux International and on the technical advisory board of the National Cybercrime Training Partnership for law enforcement. He has a Bachelor’s degree in Computer Science from Johns Hopkins University. Dave can often be found speaking on panels and giving lectures on a variety of technology issues, ranging from wireless spectrum policy and Wi-Fi, to Weblogs and Open Source software.

industry experience. Before founding Technorati, Dave was cofounder and CTO of Sputnik, a Wi-Fi gateway company, and previously, he was cofounder of Linuxcare, where he served as CTO and VP of Engineering. Dave also served as a founding member of the board of Linux International and on the technical advisory board of the National Cybercrime Training Partnership for law enforcement. He has a Bachelor’s degree in Computer Science from Johns Hopkins University. Dave can often be found speaking on panels and giving lectures on a variety of technology issues, ranging from wireless spectrum policy and Wi-Fi, to Weblogs and Open Source software.

advanced market research services and developer of

advanced market research services and developer of

directors since September 2002, and was elected as Chairman of our board of directors in May 2004. Mr. Gore has served as a Senior Advisor to

directors since September 2002, and was elected as Chairman of our board of directors in May 2004. Mr. Gore has served as a Senior Advisor to