It appears that the buyer’s profile of Live Universe is to buy web 2.0 companies in trouble on the cheap, yet preferably over funded, with some traffic and good technology, if possible. After they have bought video site Revver (also relatively cheap, price perhaps was in the $1M range) in February 2008, they have also fetched up Pageflakes just the last month for what is believed to be yet another 1M dollar deal. Yesterday we have read over Web that Live Universe has this time bought yet another start-up falling into the same profile (over funded, failed and looking for a fire sale) MeeVee. They have put themselves up for sale via press release the last month.

MeeVee is all about personalized TV guides and the company was said is having over 1.1 million organic unique users in  March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering.

March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering.

Let’s look into the Live Universe’s shopping pattern.

Total funding for Pageflakes was $4.1M – sold out for what is known to be in the $1M range. Total funding for Revver is known to be in the $12.7M range coming from Comcast, Turner, Draper Fisher Jurvetson, Bessemer Venture Partners, Draper Richards and William Randolph Hearst III – sold also out for anything between $1M and $2M. MeeVee itself has also taken a whopping amount of money from the venture capitalists — $25M over the past years, we bet on it has also been sold out for anything in the $1M / $2M range. From the 3 companies above, MeeVee seems to have traffic, at least.

It is an interesting strategy to buy companies and spur growth, but we guess it is better you buy growing start-ups rather than falling stars that have spent enormous amount of capital yet did not work things out. It is yet to be seen if this strategy is going to be successful on the long term run for Live Universe. Let’s put it that way – a company that has raised $25M and did not manage to work things out is less likely to make it with less money. On the other hand buying distressed assets is something proven by the time. From Live Universe’s perspective it seems clever move that they have bought web assets that needed more than $42M to develop for $3M or something. As web 2.0 moves towards its peak and then its end (the same as what happened with the dot com boom) there would be lots of over funded and over hyped, but failed start-ups for sale on the table for Live Universe to choose from and buy cheaply.

So to conclude if your company has taken enormous amount of money, but has definitely failed to work things out and is looking for some liquidation of its assets Live Universe might be your choice to consider.

The buying company LiveUniverse is probably most popular with the fact it has been founded by one of the founders of MySpace – Brad Greenspan. With over 55M monthly unique visitors, LiveUniverse is one of the world’s largest online entertainment networks. They operate several successful and popular websites across three core verticals: Video, Social Networking & Music. LiveVideo is one of their sites, which about a year ago instigated a scandal on YouTube when it reportedly paid top YouTube users to come to its platform. LiveUniverse founder Brad Greenspan, who was involved with MySpace early on, is perhaps best known for his lawsuits protesting the company’s sale to News Corp.

Additionally in 2006, Greenspan also initiated a lawsuit and activism site against his former company, MySpace, calling attention to the fact they were censoring widget makers and software service providers using MySpace as a development platform.

More

http://www.liveuniverse.com/

http://www.crunchbase.com/company/liveuniverse

http://meevee.com/

http://biz.yahoo.com/bw/080407/20080407006076.html

http://www.techcrunch.com/2008/04/07/25-million-later-meevee-in-trouble/

http://www.crunchbase.com/company/meevee

http://www.techcrunch.com/2007/07/16/meevee-cuts-20-of-staff/

http://www.techcrunch.com/2007/09/20/meevee-takes-35-million-series-d/

http://www.econtentmag.com/Articles/ArticleReader.aspx?ArticleID=17395

http://findarticles.com/p/articles/mi_m0EIN/is_2006_Feb_27/ai_n16085490

http://www.techmeme.com/080407/p95#a080407p95

http://www.deftapartners.com/

http://www.labrador.com/

http://www.waldenvc.com/

http://www.jpmorgan.com/pages/jpmorgan/investbk/global/na/baef

https://web2innovations.com/money/2008/02/15/revver-the-video-revenue-sharing-site-finally-sells-out-but-the-price-is-not-hefty/

https://web2innovations.com/money/2008/04/15/pageflakes-is-acquired-by-brad-greenspan%e2%80%99s-live-universe/

https://web2innovations.com/money/2008/02/15/revver-the-video-revenue-sharing-site-finally-sells-out-but-the-price-is-not-hefty/

https://web2innovations.com/money/2008/04/08/meevee-put-itself-up-for-sale/

Â

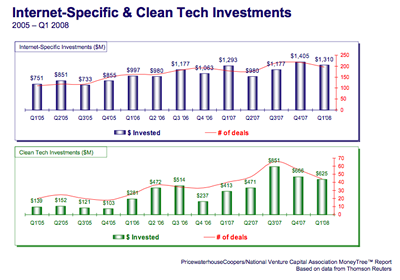

stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest.

stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest. investors continue to be the largest source of seed stage and early stage

investors continue to be the largest source of seed stage and early stage