While angel investors are taking on venture capitalists and have last year invested as much as VCs did the VC deals show a decline in the first quarter of 2008. According to a new report from PricewaterhouseCoopers, venture capital investment in the United States headed south in the first quarter of 2008.

The report found that venture capital has dropped 8.5 percent to $7.1 billion in the three months ending March 31 from the $7.8 billion invested in the previous quarter, resulting in the lowest quarter since Q4 2006. Funding for early and late  stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest.

stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest.

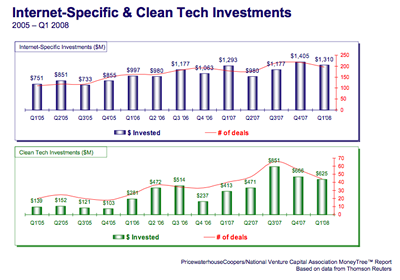

In more specific the VC money going into the software sector (including Internet, Web, IT) declined 9 percent quarter-over-quarter and flat year-over-year to $1.264B and is said to be equal with the amount invested in biotech companies ($1.267B). In perspective to the only Internet deals those declined 7 percent from the fourth quarter of 2007 to $1.310 billion, but were slightly up year-over-year. Clean tech investments have gone crazy and hit the peak in third quarter of 2007 during which period more than $851M was invested.

In the context of web 2.0 it could simply be the fact that it is dirty cheap lately to start a new web-2.0 company online and the VC money offered to those is always a bit more than what this company in particular needs from to get off the ground and stabilize. This could be seen as a reason why the VC deals for Internet only start-ups have slightly declined in the last 2 quarters. Another potential reason of this slight meltdown could be the fact that the first quarter of the calendar year is usually the quietest so part of the decline may be seasonal.

Yet, the most logical reason could be the overall economy meltdown in US, which might now have its impact over the VC market too.

More

http://www.pwc.com/

http://www.techcrunch.com/2008/04/18/is-the-venture-capital-party-over/

http://www.boston.com/business/articles/2008/04/19/venture_capital_funding_diminishes/

http://venturebeat.com/2008/04/18/its-official-venture-investment-declined-in-q1/

http://www.techcrunch.com/2008/04/20/vc-deals-in-charts-q1-2008%e2%80%94welcome-to-the-slowdown/

https://web2innovations.com/money/2008/04/18/angel-investors-have-invested-as-much-as-26-billion-in-start-ups-last-year-almost-as-much-as-vcs-did/

http://dondodge.typepad.com/the_next_big_thing/2008/04/angel-investors.html

http://www.techcrunch.com/2008/04/15/where-have-all-the-bold-vcs-gone/

http://www.nvca.org/ffax.html

http://www.paulgraham.com/googles.html

http://money.cnn.com/2006/02/28/magazines/business2/angelinvestor/