Today we are living in web 2.0 times more than ever before. PR, press coverage, buzz, evangelism, lobbying, who knows who, who blogs who, who talks about who, mainstream media and beyond – all of those words found in the dictionary of almost every new web site that coins itself as web 2.0, but as the global economy crisis is raising upon us promising to leave us working in a very depressed business environment with little to no liquidation events at all for the next years the real question is: who the real winners in today’s web 2.0 space are based on real people using their web properties since 2005 the web 2.0 term was coined for first time. Since then we have witnessed hundreds of millions of US dollars poured into different web 2.0 sites, applications and technologies and perhaps now is the time to find out which of those web sites have worked things out. We took the time necessary to discover today’s most popular web 2.0 sites based on real traffic and site usage and Not on buzz or size of funding. Sites are ranked based on the estimated traffic figures. After spending years in assessing web 2.0 sites applying tens of different from economical and technological to media criteria in an effort to evaluate them we came up to the conclusion that there is only one criterion worth our attention and it is the real people that use a given site, the traffic, the site usage, etc., based on which the web site can successfully be monetized. Of course, there are a few exceptions from the general rule like sites with extremely valuable technologies and no traffic at all, but as we said, they are exceptions. Ad networks, web networks, hosted networks and group of sites that use consolidated traffic numbers as their own or such ones that rely on the traffic of other sites to boost their own figures (ex.: various ad networks, Quantcast, WordPress etc.) are not taken into consideration and the sites from within those respective networks and groups have been ranked separately. International traffic is of course taken into consideration. Add ons, social network apps and widgets usage is not taken into consideration. Sub-domains as well as international TLDs part of the principal business of the main domain/web site are included. Media sites including such covering the web 2.0 space have also been included. Old buys from the dot com era are not considered and ranked accordingly.

Disclaimer: some data based on which the sites below are ranked may not be complete or correct due to lack of public data available for the traffic of respective sites. Please also note that the data taken into consideration for the ranking may have meanwhile changed and might possibly be no longer the same at the time you are reading the list. Data has been gathered during the months of July, August, September and December 2008.

Today’s most popular Web 2.0 sites based on the traffic they get as measured during the months of July, August and September 2008.

Priority is given to direct traffic measurement methods wherever applicable. Panel data as well as toolbar traffic figures are not taken into cosndieration. Traffic details as taken from Quantcast, Google Analytics*, Nielsen Site Audit, Nielsen NetRatings, comScore Media Metrix, internal server log files*, Compete and Alexa. Press release, public relation and buzz traffic and usage figures as they have appeared in the mainstream and specialized media are given with lower priority unless supported by direct traffic measurement methods.

*wherever applicable

Web Property / Unique visitors per month

- WordPress.com ~ 100M

- YouTube.com ~ 73M

- MySpace.com ~ 72M

- Wikipedia.org ~ 69M

- Hi5.com ~ 54M

- Facebook.com ~ 43M

- BlogSpot.com ~ 43M

- PhotoBucket.com ~ 34M

- MetaCafe.com ~ 30M

- Blogger.com ~ 27M

- Flickr.com ~ 23M

- Scribd.com ~ 23M

- Digg.com ~ 21M

- Typepad.com ~ 17M

- Imeem.com ~ 17M

- Snap.com ~ 15.7M

- Fotolog.com ~ 15.6M

- RockYou.com ~ 15M

- Veoh.com ~ 12M

- Wikihow.com ~ 12M

- Topix.com ~ 11.5M

- Blinkx.com ~ 11M

- HuffingtonPost.com ~ 11M

- Technorati.com ~ 10.6M

- Wikia.com ~ 10.8M

- Zimbio.com ~ 10.3M

- SpyFu.com ~ 10.1M

- Heavy.com ~ 9.3M

- Yelp.com ~ 8.9M

- Slide.com ~ 8.5M

- SimplyHired.com ~ 8.5M

- Squidoo.com ~ 8.1M

- LinkedIn.com ~ 7.5M

- HubPages.com ~ 7.2M

- Hulu.com ~ 7.1M

- AssociatedContent.com ~ 7M

- Indeed.com ~ 5.4M

- LiveJournal.com ~ 5.2M

- Bebo.com ~ 5.1M

- Habbo.com ~ 4.9M

- Fixya.com ~ 4.5M

- RapidShare.com ~ 4.5M

- AnswerBag.com ~ 4.4M

- Metafilter.com ~ 4.3M

- Crackle (Grouper) ~ 4M

- Ning.com ~ 3.8M

- Breitbart.com ~ 3.8M

- BookingBuddy.com ~ 3.7M

- Kayak.com ~ 3.6M

- Blurtit.com ~ 3.2M

- Kaboodle.com ~ 3M

- Meebo.com ~ 2.9M

- Friendster.com ~ 2.7M

- WowWiki.com ~ 2.8M

- Truveo.com ~ 2.7M

- Trulia.com ~ 2.7M

- Twitter.com ~ 2.5M

- BoingBoing.net ~ 2.4M

- Techcrunch.com ~ 2.2M

- Zillow.com ~ 2.2M

- MyNewPlace.com ~ 2.2M

- Mahalo.com ~ 2.1M

- Vox.com ~ 2M

- Last.fm ~ 2M

- Glam.com ~ 1.9M

- Multiply.com ~ 1.9M

- Popsugar.com ~ 1.6M

- Addthis.com ~ 1.5M

- Pandora.com ~ 1.4M

- Brightcove.com ~ 1.4M

- LinkedWords.com ~ 1.3M

- Devshed.com ~ 1.3M

- AppleInsider.com ~ 1.3M

- Newsvine.com ~ 1.3M

- Fark.com ~ 1.2M

- BleacherReport.com ~ 1.2M

- Mashable.com ~ 1.2M

- Zwinky.com ~ 1.2M

- Quantcast.com ~ 1.2M

- StumbleUpon.com ~ 1.1M

- SecondLife.com ~ 1.1M

- Magnify.net ~ 1.1M

- Uncyclopedia.org ~ 1M

- Weblo.com ~ 1M

- Del.icio.us ~ 1M

- Reddit.com < 1M

- Pbwiki.com < 1M

- AggregateKnowledge.com < 1M

- Eventful.com < 1M

- Dizzler.com < 1M

- Synthasite.com < 1M

- Vimeo.com < 1M

- Zibb.com <1M

Web 2.0 sites having less than 1M unique visitors per month even though popular in one way or another are not subject of this list and are not taken into consideration. We know for at least 100 other considered really good web 2.0 sites, apps and technologies of today, but since they are getting less than 1M uniuqes per month they were not able to make our list. However, sites being almost there (850K-950K/mo) and believed to be in position to reach the 1M monthly mark in the next months are also included at the bottom of the list. Those sites are marked with “<“, which means close to 1M, but not yet there. No hard feelings :).

If we’ve omitted one site or another that you know is getting at least 1M uniques per month and you are not seeing it above, drop us a note at info[at]web2innovations.com and we’ll have it included. Please note that the site proposed should be having steady traffic for at least 3 months prior submission to the list above. Sites like, for example: Powerset and Cuil, may not qualify for inclusion due to their temporary traffic leaps caused by buzz they have gotten, a criterion we try to offset. For other corrections and omissions please write at same email address. Requests for corrections of the traffic figures the sites are ranked on can only be justified by providing us with the accurate traffic numbers from reliable direct measurement sources (Quantified at Quantcast, Google Analytics, Nielsen Site Audit, Nielsen NetRatings, comScore Media Metrix, internal server log files, other third party traffic measurement services that use the direct method. No panel data, no Alexa, no Compete etc. will be taken into consideration).

* Note that ranks given to sites at w2i reflect only our own vision for and understanding of the site usage, traffic and unique visitors of the sites being ranked and does not necessarily involve other industry experts’, professionals’, journalists’ and bloggers’ opinions. You acknowledge that any ranking available on web2innovations.com (The Site) is for informational purposes only and should not be construed as investment advice or a recommendation that you, or anyone you advise, should buy, acquire or invest in any of the companies being analyzed and ranked on the Site, or undertake any investment strategy, based on rankings seen on the Site. Moreover, if a company is described or mentioned in our Site, you acknowledge that such description or mention does not constitute a recommendation by web2innovations.com that you engage or otherwise use such web site.

departure, it was unclear what would happen to Jangl’s assets and remaining staff. Wonder no longer –

departure, it was unclear what would happen to Jangl’s assets and remaining staff. Wonder no longer –  March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering.

March up from 480,000 in August 2007. The Company uses its editorial voice and proprietary technology to scour a curated list of thousands of sources to connect consumers with customized video, blog and TV programming content that matches their interests. The Company has significant issued IP, community, media relationships, a TV listings personalization engine, streaming TV directory and a compelling product roadmap. The Company has 7 full time employees, all in product and engineering.

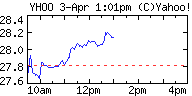

goal in pursuing a combination with Yahoo! was to provide greater choice and innovation in the marketplace and create real value for our respective stockholders and employees,†said Steve Ballmer, chief executive officer of Microsoft.

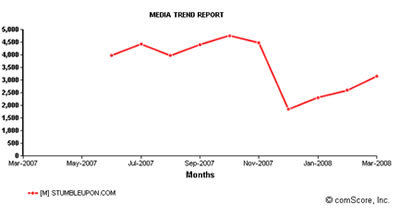

goal in pursuing a combination with Yahoo! was to provide greater choice and innovation in the marketplace and create real value for our respective stockholders and employees,†said Steve Ballmer, chief executive officer of Microsoft. seem to drag the attention of influential technology bloggers to the number of their registered users and the number of their stumbles.

seem to drag the attention of influential technology bloggers to the number of their registered users and the number of their stumbles. “Gracenote is a global leader in technology and services for

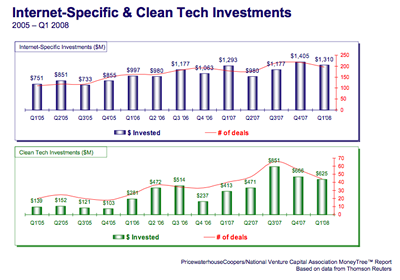

“Gracenote is a global leader in technology and services for  stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest.

stage companies declined in the first quarter, though funding rose for expansion-stage companies. Some sources claim that new startups are being hit the hardest. investors continue to be the largest source of seed stage and early stage

investors continue to be the largest source of seed stage and early stage  ads and according to the company is currently integrated into over 70,000 leading sites and is live on over 2 Billion monthly article pages across the web. If true that is pretty impressive number and should have been able to command a price way higher than the $25M rumored to have been paid for the company.

ads and according to the company is currently integrated into over 70,000 leading sites and is live on over 2 Billion monthly article pages across the web. If true that is pretty impressive number and should have been able to command a price way higher than the $25M rumored to have been paid for the company. The company’s strategy focuses on increasing the scale and sophistication of its advertising platform and growing the size and engagement of its global online audience through leading products and programming.

The company’s strategy focuses on increasing the scale and sophistication of its advertising platform and growing the size and engagement of its global online audience through leading products and programming.

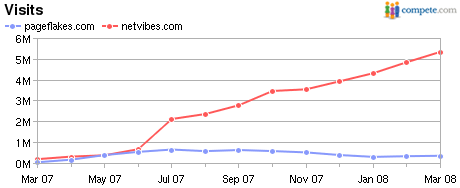

web start page that keeps you up to date on the many blogs and news sources that you read daily. Add

web start page that keeps you up to date on the many blogs and news sources that you read daily. Add  company’s product vision. Dan is a seasoned

company’s product vision. Dan is a seasoned  February official terms were not disclosed, but some insiders have speculated the price tag has been less than $5M. What we do not understand is how a company with over $10M in venture capital money and quite solid technology has ended up selling itself under fire. Imeem is known to have been licensing the company’s

February official terms were not disclosed, but some insiders have speculated the price tag has been less than $5M. What we do not understand is how a company with over $10M in venture capital money and quite solid technology has ended up selling itself under fire. Imeem is known to have been licensing the company’s

Sources “close to the company†tell the

Sources “close to the company†tell the  enables the compatibility, connectivity, security, and manageability of the various components and technologies used in such devices. It sells these products primarily to computer and component device manufacturers. Phoenix Technologies has more than 300 employees and company’s today

enables the compatibility, connectivity, security, and manageability of the various components and technologies used in such devices. It sells these products primarily to computer and component device manufacturers. Phoenix Technologies has more than 300 employees and company’s today  open standards and deliver innovative solutions that will help them differentiate their systems, reduce time-to-market and increase their revenues. The Company’s flagship products, AwardCore, SecureCore, FailSafe and HyperSpace, are revolutionizing the PC user experience by delivering unprecedented security, reliability and ease-of-use. The Company established industry leadership with its original BIOS product in 1983, has 155 technology patents and 139 pending applications, and has shipped in over one billion systems. Phoenix is headquartered in Milpitas, California with offices worldwide.

open standards and deliver innovative solutions that will help them differentiate their systems, reduce time-to-market and increase their revenues. The Company’s flagship products, AwardCore, SecureCore, FailSafe and HyperSpace, are revolutionizing the PC user experience by delivering unprecedented security, reliability and ease-of-use. The Company established industry leadership with its original BIOS product in 1983, has 155 technology patents and 139 pending applications, and has shipped in over one billion systems. Phoenix is headquartered in Milpitas, California with offices worldwide.